I'm selling funds at a loss if I can find equal or better funds in the same fund categories to replace them with. I'm doing this to claim the losses against my 2008 taxes. This should increase the size of my tax return. I plan to take the extra cash and invest it, assuming the markt is still beaten down when I get my refund.

Back in March of 2007, Managers Bond MGFIX looked great. Other bond funds have held up well, but the managers of this fund have taken failure to a new level. It has lost over 21% this year and its expenses have actually gone up. I'll take TGMNX TCW Total Return Bond which has posted a slight gain year to date.

Another fund that looked good in March of 2007 was SSMEX, SSGA Emerging Markets. Most Emerging Market funds looked good then, but this one rose above the field. LZOEX has lost over 50% this year, but that is not as much as SSMEX. LZOEX has a better long term record, but slightly higher expenses, which bums me out a little. I'm sitting on too big a loss to not take the tax write off here so I'm selling SSMEX and buying LZOEX.

In January of 2007, AAGPX American Beacon Large Cap Value Planahead looked like a safe bet. Value funds have taken a serious beating, but many funds have held up far better than this one. I'm buying AMANX Amana Trust Income.

I bought JASCX James Small Cap well before I put together the WylieMoney portfolios. Despite that I'm sitting on a loss and there are better options. I'm buying RSEFX Royce Special Equity SVC.

Bond- Intermediate Term

Selling: MGFIX Managers Bond

Buying: TGMNX TCW Total Return Bond

Foreign- Emerging Markets

Selling: SSMEX SSGA Emerging Markets

Buying: LZOEX Lazard Emerging Markets Equity Open

Domestic- Large Cap Value

Selling: AAGPX American Beacon Large Cap Value Planahead

Buying: AMANX Amana Trust Income

Domestic- Small Cap Value

Selling: JASCX James Small Cap

Buying: RSEFX Royce Special Equity SVC

12.29.2008

Fund of the Week: DLS WisdomTree International SmallCap

The week ending 12/26/08 saw some foreign funds and intermediate bond funds posting modest gains with DLS WisdomTree International SmallCap doing best, gaining 1.82%.

Emerging Markets and Mid caps, and a variety of other funds posted losses with VWO Vanguard Emerging Markets Stock ETF losing the most, down 8.27% for the week.

Emerging Markets and Mid caps, and a variety of other funds posted losses with VWO Vanguard Emerging Markets Stock ETF losing the most, down 8.27% for the week.

12.28.2008

Portfolio Update 12/26/08: We are the Champions

We are the champions...

The ETF 20 portfolio fell behind the WylieMoney 20 Mostly Managed portfolio. My portfolios are in 1st and 2nd place.

I rule.

Of course my actual portfolios are 3rd from last and 2nd from last...

The ETF 20 portfolio fell behind the WylieMoney 20 Mostly Managed portfolio. My portfolios are in 1st and 2nd place.

I rule.

Of course my actual portfolios are 3rd from last and 2nd from last...

Labels:

Investing,

Mutual Fund,

Non-Retirement

Making Lemonade Out of Lemons: Profiting from Mutual Fund Losses

If you a bought mutual fund in the last few years, chances are good, you're looking at a loss in that fund. If you've sold some equities for a profit, earned income this year or your fund paid a capital gains distribution or dividend, chances are good you owe taxes.

Did you know you can lower your taxes by selling your fund at a loss, if you hold it in a taxable account (not a 401k or 403b or IRA account)?

You might say "But wait a minute, Wylie! Buying high and selling low is a terrible investing strategy. If I sell my fund and the markets rally tomorrow, my calm will be seriously damaged."

"Whooooaaaaaa nelly..." is how I would respond. I don't think you should get out of the market while the markets are down.

What I am going to do (and what you may want to consider doing, if it makes sense given your situation) is look at the funds I own and sell a fund at a loss when I can find an equal or better fund in the same category that I can buy on the same day I sell. That way I remain 100% invested. I'll actually buy more in some categories and less in others to re-balance a bit, but you get the idea.

You might ask, 'what's the catch?'

There are several things to be aware of! The biggest catch is the Wash Sale rule. You can read a good detailed explanation of this here. Basically if you sell one security (for our purposes, this includes mutual funds, ETFs, or ETNs) and buy a "substantially identical" security within a certain number of days, you can't take the tax loss.

My understanding of this rule is that if you sell an index fund and replace it with a different fund that tracks the same index, you are likely to run into this. But if you sell a managed fund and replace it with an index fund, or vice versa, the investment strategies are fundamentally different. Even selling one managed fund and replacing it with another should be fine (but I'm not an accountant so do your own homework), assuming the managers dont use the same analysts/strategy, etc.

One risk is that the new fund you buy may not do as well as the old fund, but since we can't predict fund performance, I find this risk negligible. It is just as likely the new fund will do better, but that is not the reason to make the change. Expenses, turnover, and proven success from the manager and fund company are the best criteria for finding a solid fund to add to a taxable account, so if there are other good options out there, and you are sitting on a fund with a solid loss, why not take the loss and buy the new fund so that you remain invested in the category you want represented in your portfolio?

Other issues to consider...

Issue:

When you sell a mutual fund, the money from that transaction won't be available for several days so you need additional cash to buy a different fund on the same day. If I sell $2000 from Fund X and want to put $2000 into Fund Y, I'll need $2000 in cash in addition to the $2000 in fund X ($4000 total) in my brokerage account to buy and sell on the same day.

Solution:

If you have an emergency fund, you can use it to pull this off. Once all the cash from your sell orders are posted, you can put that back in your emergency fund. The downside is that you won't have that cash for a few days and if the market tanks after you place your sell order, you may end up with less $ than you planned.

Issue:

Your basis on the new purchase will be calculated on the day you buy. So if the markets rally back to where they were when you bought in and you sell, you'll owe taxes. You would not owe taxes if you simply hold on and the market rebounds and you sell at the same level you originally bought in at.

Solution:

There is none. If you make a profit in a taxable account, you owe taxes. Quit complaining and pay your patriotic share!

Keep in mind that it could take a while for markets to recover and that the tax rate on capital gains can't go much lower but it can go higher. So saving money now, means more money in your hands now to invest. If you save money on taxes and invest it, you'll have a bigger stake in the market which is a good thing if it does rally. Sure you'll owe taxes later (unless you come up with some other plan like this one) but you'll owe it on bigger profits than you would otherwise make and making bigger profits is kinda the point of investing.

Issue:

If I just bought a fund or invested in one, many funds charge a fee for selling right away and some brokerages, like Etrade which I use, charge their own fee, for selling no load, no fee funds (they charge a fee on no fee funds- hahahaha) if you sell in 3 months.

Solution:

Do your research. If you are going to be socked with fees, even thought you already lost a lot of value on a fund you just purchased, this plan may not make sense. You may want to wait until the required amount of time passes, to avoid any fees. So you don't get the tax write-off this year, you planning to not earn any income next year? You think the markets will rally 40% in the next 3 months?

Issue:

You have many many thousands of dollars in losses and no gains. How much will this really help?

Solution:

Talk to you accountant. You can write off up to $3000.00 against your income each year and losses carry forward so if you have gains or income next year, it is my understanding the loss you did not apply against your gains this year will apply nxt year and so on until you run out. But the longer it takes to reap the benefit, the more other issues come into play. If the market rallies next year, the unused tax savings may not be worth the new tax obligation you're now holding. Of course this depends on how long you plan to hold the funds...

Issue:

The fund you bought had a $2500 minimum initial purchase amount. You've lost $1000 in that fund. The better fund you found also has a $2500 initial minimum purchase amount, but you only have $1500 invested in this fund category. You'd have to add another $1000 to this category to buy the new fund.

Solution(s):

Add another $1000, pick a fund with a lower initial minimum or don't sell.

Summary:

If you have capital gains from this year- many funds that are down for the year still paid out capital gains distributions in the last few weeks and you WILL owe taxes on those distributions regardless of whether you sell or not- or earned some income, then this is worth considering. You'll need extra cash and you'll need to find equal or better funds to buy.

I can't help you with the extra cash, but I will share which funds I'm selling and which funds I'm replacing them with... I hope it helps!

Did you know you can lower your taxes by selling your fund at a loss, if you hold it in a taxable account (not a 401k or 403b or IRA account)?

You might say "But wait a minute, Wylie! Buying high and selling low is a terrible investing strategy. If I sell my fund and the markets rally tomorrow, my calm will be seriously damaged."

"Whooooaaaaaa nelly..." is how I would respond. I don't think you should get out of the market while the markets are down.

What I am going to do (and what you may want to consider doing, if it makes sense given your situation) is look at the funds I own and sell a fund at a loss when I can find an equal or better fund in the same category that I can buy on the same day I sell. That way I remain 100% invested. I'll actually buy more in some categories and less in others to re-balance a bit, but you get the idea.

You might ask, 'what's the catch?'

There are several things to be aware of! The biggest catch is the Wash Sale rule. You can read a good detailed explanation of this here. Basically if you sell one security (for our purposes, this includes mutual funds, ETFs, or ETNs) and buy a "substantially identical" security within a certain number of days, you can't take the tax loss.

My understanding of this rule is that if you sell an index fund and replace it with a different fund that tracks the same index, you are likely to run into this. But if you sell a managed fund and replace it with an index fund, or vice versa, the investment strategies are fundamentally different. Even selling one managed fund and replacing it with another should be fine (but I'm not an accountant so do your own homework), assuming the managers dont use the same analysts/strategy, etc.

One risk is that the new fund you buy may not do as well as the old fund, but since we can't predict fund performance, I find this risk negligible. It is just as likely the new fund will do better, but that is not the reason to make the change. Expenses, turnover, and proven success from the manager and fund company are the best criteria for finding a solid fund to add to a taxable account, so if there are other good options out there, and you are sitting on a fund with a solid loss, why not take the loss and buy the new fund so that you remain invested in the category you want represented in your portfolio?

Other issues to consider...

Issue:

When you sell a mutual fund, the money from that transaction won't be available for several days so you need additional cash to buy a different fund on the same day. If I sell $2000 from Fund X and want to put $2000 into Fund Y, I'll need $2000 in cash in addition to the $2000 in fund X ($4000 total) in my brokerage account to buy and sell on the same day.

Solution:

If you have an emergency fund, you can use it to pull this off. Once all the cash from your sell orders are posted, you can put that back in your emergency fund. The downside is that you won't have that cash for a few days and if the market tanks after you place your sell order, you may end up with less $ than you planned.

Issue:

Your basis on the new purchase will be calculated on the day you buy. So if the markets rally back to where they were when you bought in and you sell, you'll owe taxes. You would not owe taxes if you simply hold on and the market rebounds and you sell at the same level you originally bought in at.

Solution:

There is none. If you make a profit in a taxable account, you owe taxes. Quit complaining and pay your patriotic share!

Keep in mind that it could take a while for markets to recover and that the tax rate on capital gains can't go much lower but it can go higher. So saving money now, means more money in your hands now to invest. If you save money on taxes and invest it, you'll have a bigger stake in the market which is a good thing if it does rally. Sure you'll owe taxes later (unless you come up with some other plan like this one) but you'll owe it on bigger profits than you would otherwise make and making bigger profits is kinda the point of investing.

Issue:

If I just bought a fund or invested in one, many funds charge a fee for selling right away and some brokerages, like Etrade which I use, charge their own fee, for selling no load, no fee funds (they charge a fee on no fee funds- hahahaha) if you sell in 3 months.

Solution:

Do your research. If you are going to be socked with fees, even thought you already lost a lot of value on a fund you just purchased, this plan may not make sense. You may want to wait until the required amount of time passes, to avoid any fees. So you don't get the tax write-off this year, you planning to not earn any income next year? You think the markets will rally 40% in the next 3 months?

Issue:

You have many many thousands of dollars in losses and no gains. How much will this really help?

Solution:

Talk to you accountant. You can write off up to $3000.00 against your income each year and losses carry forward so if you have gains or income next year, it is my understanding the loss you did not apply against your gains this year will apply nxt year and so on until you run out. But the longer it takes to reap the benefit, the more other issues come into play. If the market rallies next year, the unused tax savings may not be worth the new tax obligation you're now holding. Of course this depends on how long you plan to hold the funds...

Issue:

The fund you bought had a $2500 minimum initial purchase amount. You've lost $1000 in that fund. The better fund you found also has a $2500 initial minimum purchase amount, but you only have $1500 invested in this fund category. You'd have to add another $1000 to this category to buy the new fund.

Solution(s):

Add another $1000, pick a fund with a lower initial minimum or don't sell.

Summary:

If you have capital gains from this year- many funds that are down for the year still paid out capital gains distributions in the last few weeks and you WILL owe taxes on those distributions regardless of whether you sell or not- or earned some income, then this is worth considering. You'll need extra cash and you'll need to find equal or better funds to buy.

I can't help you with the extra cash, but I will share which funds I'm selling and which funds I'm replacing them with... I hope it helps!

Labels:

Investing,

Mutual Fund,

Non-Retirement,

Taxes

12.22.2008

Fund of the Week: TLT iShares Barclays 20+ Year Treas Bond

TLT iShares Barclays 20+ Year Treas Bond gained 8.8% last week. Real Estate had a strong week. The rest of the top ten funds from my mutual fund experiment were from a variety of categories.

The worst performing fund was BRSIX Bridgeway Ultra-Small Company Market, which lost 6.54%. The other funds in the botom 10 were also from a variety of categories.

The worst performing fund was BRSIX Bridgeway Ultra-Small Company Market, which lost 6.54%. The other funds in the botom 10 were also from a variety of categories.

The worst performing fund was BRSIX Bridgeway Ultra-Small Company Market, which lost 6.54%. The other funds in the botom 10 were also from a variety of categories.

The worst performing fund was BRSIX Bridgeway Ultra-Small Company Market, which lost 6.54%. The other funds in the botom 10 were also from a variety of categories.

Labels:

Investing,

Mutual Fund,

Non-Retirement

12.21.2008

Portfolio Update 12/19/08: Wanderlust

Diverse portfolios up over 3%, the S&P 500 down almost 1%, all in a week... The markets are all over the place. Must be suffering from a bit o wanderlust.

The ETF 20 portfolio clings to its lead over the WylieMoney 20 Mostly Managed portfolio with a 0.02% advantage.

Several of these portfolios have rallied over 10% in the last month. Still a long way to go, but I'll take what I can get.

The ETF 20 portfolio clings to its lead over the WylieMoney 20 Mostly Managed portfolio with a 0.02% advantage.

Several of these portfolios have rallied over 10% in the last month. Still a long way to go, but I'll take what I can get.

Labels:

Investing,

Mutual Fund,

Non-Retirement

12.15.2008

Fund of the Week: Jennison Natural Resources

Jennison Natural Resources PNRZX gained 17.33% last week. The top ten funds all were energy or international funds and were all funds that have lost over 45% on the year.

The biggest loser was Schwab Financial Services SWFFX. The bottom 10 funds were a mix of stocks and bonds.

The biggest loser was Schwab Financial Services SWFFX. The bottom 10 funds were a mix of stocks and bonds.

The biggest loser was Schwab Financial Services SWFFX. The bottom 10 funds were a mix of stocks and bonds.

The biggest loser was Schwab Financial Services SWFFX. The bottom 10 funds were a mix of stocks and bonds.

Labels:

Investing,

Mutual Fund,

Non-Retirement

12.14.2008

Portfolio Update 12/12/08

Another good week. Could this be the bottom?

Is this It?

We'll see. Despite some big daily drops here and there, the last few weeks have trended up.

The WylieMoney Slowly portfolio had a rough Friday, but extended its lead with the best one week performance of the bunch.

The WylieMoney Slowly portfolio had a rough Friday, but extended its lead with the best one week performance of the bunch.

Is this It?

We'll see. Despite some big daily drops here and there, the last few weeks have trended up.

The WylieMoney Slowly portfolio had a rough Friday, but extended its lead with the best one week performance of the bunch.

The WylieMoney Slowly portfolio had a rough Friday, but extended its lead with the best one week performance of the bunch.

Labels:

Investing,

Mutual Fund,

Non-Retirement

12.08.2008

Some Perspective- Bridgeway Funds Shareholder Letter

John Montgomery started Bridgeway Capital and manages 10 Bridgeway Funds. His letters to shareholders are always worth a read as he actually offers some perspective instead of just spinning his fund's performance relative to their benchmarks (you can find that for Bridgeway funds too, of course).

You can find his letter here. A number of items in his letter struck me and I'd like to share them with you.

John says:

"Three out of any ten years in the stock market have been negative. Sometimes it looks ugly. That’s the “nature of the beast.” OK, but human nature is to look, so let’s put the current bear market in perspective:"

Equities can and do fall and fall hard and we've been here before. After a big fall, when will we be making gains?

John says:

"One interesting and powerful measure of risk is what I call “time to recover.” This is the time from a previous market “high” (or “previous peak”) until it reaches that level again. These numbers are much more comforting than the magnitude of decline and worthy of studying:"

Assuming the markets do recover, will it look like fall of 1982? Two months to make up 21 months of losses? Hard to imagine, but I bet it was hard to imagine then and that is the real risk of trying to time the market. If you moved out of stocks, how will you know when to get back in? The recovery after to 2000 peak took 4 years. 2 months or 4 years, which would you prefer?

If your time horizon is long, you might prefer 4 years. Am I crazy? Sure. But the investments I made during the 2000- 2004 have all done better than anything I invested from 2005 to today.

John continues:

"The most powerful weapon at your disposal while awaiting a recovery is your expense level. Say you could save an additional 10% by cutting back in certain areas of your budget. If you were to invest those savings, I call this “super dollar cost averaging.” Because you do it when the market is down, these dollars buy more shares (than previously), and can more significantly boost your long-term wealth whenever the market does eventually recover."

If the market recovers fast,there will be less time to 'super dollar cost average.'

If you enjoyed the quotes, read the entire letter. I own several Bridgeway funds and hope they recover as fast as they've fallen. Truth is, the only funds I own that I have consistently added to every month this year (outside of my retirement plan through work) are two Bridgeway funds.

You can find his letter here. A number of items in his letter struck me and I'd like to share them with you.

John says:

"Three out of any ten years in the stock market have been negative. Sometimes it looks ugly. That’s the “nature of the beast.” OK, but human nature is to look, so let’s put the current bear market in perspective:"

Equities can and do fall and fall hard and we've been here before. After a big fall, when will we be making gains?

John says:

"One interesting and powerful measure of risk is what I call “time to recover.” This is the time from a previous market “high” (or “previous peak”) until it reaches that level again. These numbers are much more comforting than the magnitude of decline and worthy of studying:"

Assuming the markets do recover, will it look like fall of 1982? Two months to make up 21 months of losses? Hard to imagine, but I bet it was hard to imagine then and that is the real risk of trying to time the market. If you moved out of stocks, how will you know when to get back in? The recovery after to 2000 peak took 4 years. 2 months or 4 years, which would you prefer?

If your time horizon is long, you might prefer 4 years. Am I crazy? Sure. But the investments I made during the 2000- 2004 have all done better than anything I invested from 2005 to today.

John continues:

"The most powerful weapon at your disposal while awaiting a recovery is your expense level. Say you could save an additional 10% by cutting back in certain areas of your budget. If you were to invest those savings, I call this “super dollar cost averaging.” Because you do it when the market is down, these dollars buy more shares (than previously), and can more significantly boost your long-term wealth whenever the market does eventually recover."

If the market recovers fast,there will be less time to 'super dollar cost average.'

If you enjoyed the quotes, read the entire letter. I own several Bridgeway funds and hope they recover as fast as they've fallen. Truth is, the only funds I own that I have consistently added to every month this year (outside of my retirement plan through work) are two Bridgeway funds.

12.07.2008

Fund of the Week (again): BTTRX American Century Target 2025

BTTRX American Cenutry Target Maturity 2025 My Post outperformed all other funds this week, up 5.3%. A government bond fund, up over 21% this year.

Real Estate funds also held their ground last week along with bonds. I included the top 11 to show that last week's winner SWFFX Schwab Financial Services also finished the week with a gain.

Energy funds got hammered and international funds suffered, rounding out the bottom 10. The worst preformer this week, PNRZX Jennison Natural Resources, fell 17.78% and is down over 60% this year as it continues to collapse along with the price of oil.

Energy funds got hammered and international funds suffered, rounding out the bottom 10. The worst preformer this week, PNRZX Jennison Natural Resources, fell 17.78% and is down over 60% this year as it continues to collapse along with the price of oil.

Real Estate funds also held their ground last week along with bonds. I included the top 11 to show that last week's winner SWFFX Schwab Financial Services also finished the week with a gain.

Energy funds got hammered and international funds suffered, rounding out the bottom 10. The worst preformer this week, PNRZX Jennison Natural Resources, fell 17.78% and is down over 60% this year as it continues to collapse along with the price of oil.

Energy funds got hammered and international funds suffered, rounding out the bottom 10. The worst preformer this week, PNRZX Jennison Natural Resources, fell 17.78% and is down over 60% this year as it continues to collapse along with the price of oil.

Labels:

Investing,

Mutual Fund,

Non-Retirement

12.06.2008

Portfolio Update 12/05/08: Alfie

This market is as worthless as Alfie.

Another down week, but at least Friday we saw a strong rebound.

The WylieMoney Slowly Portfolio is the best performing portfolio of my experiment. It comes as no surprise that adding funds after the market has fallen 30% will result in smaller losses comparatively, even if the market continues to fall. The WylieMoney Slowly Portfolio gained a fund each month with the December addition rounding out the 20 funds that will be added.

Of the portfolios that saw $50,000 invested on 5/01/07, the ETF portfolio has done the best but not by much. Basically, if you wanted to reinvest dividends, or add small amounts, the WylieMoney 20 would have been your best bet and if you wanted to invest $50,000 and forget about it ETFs would have been the way to go.

Of course, if you wanted to make money, none of the options were sound. Ah, hindsight.

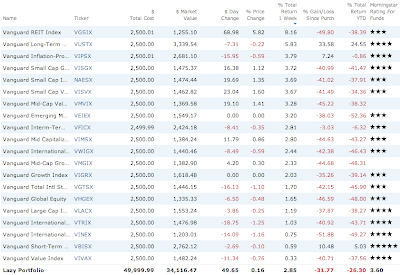

All told, I'm most surprised by how little difference there has ben. The diverse portfolio of mostly managed funds (WylieMoney) has performed within 2% of mostly Index funds (Lazy), despite all the crazy day to day swings.

Another down week, but at least Friday we saw a strong rebound.

The WylieMoney Slowly Portfolio is the best performing portfolio of my experiment. It comes as no surprise that adding funds after the market has fallen 30% will result in smaller losses comparatively, even if the market continues to fall. The WylieMoney Slowly Portfolio gained a fund each month with the December addition rounding out the 20 funds that will be added.

Of the portfolios that saw $50,000 invested on 5/01/07, the ETF portfolio has done the best but not by much. Basically, if you wanted to reinvest dividends, or add small amounts, the WylieMoney 20 would have been your best bet and if you wanted to invest $50,000 and forget about it ETFs would have been the way to go.

Of course, if you wanted to make money, none of the options were sound. Ah, hindsight.

All told, I'm most surprised by how little difference there has ben. The diverse portfolio of mostly managed funds (WylieMoney) has performed within 2% of mostly Index funds (Lazy), despite all the crazy day to day swings.

Labels:

Investing,

Mutual Fund,

Non-Retirement

12.01.2008

Fund of the Week: SWFFX Schwab Financial Services

SWFFX Schwab Financial Services was the best performing fund of the week. It's about time this fund showed some life. I bought this earlier in the year when one of my brothers talked me into it. I should have known better- he has a habit of picking losers.

The rest of the top ten were real estate funds and small and mid cap funds.

The bottom 10 funds were all bonds, but even the biggest loser, ACITX American Century Inflation Protected only lost -0.2%.

The rest of the top ten were real estate funds and small and mid cap funds.

The bottom 10 funds were all bonds, but even the biggest loser, ACITX American Century Inflation Protected only lost -0.2%.

Labels:

Investing,

Mutual Fund,

Non-Retirement

11.30.2008

Next WylieMoney Slowly Fund: ACITX American Century Inflation Adj Bond

The next and last fund I'm adding to the WylieMoney Slowly portfolio is the inflation protected bond fund: ACITX American Century Inf My Post.

There is only one no-load, no fee option available through Etrade. I picked it before, I'm picking it again.

I'm adding it tomorrow.

There is only one no-load, no fee option available through Etrade. I picked it before, I'm picking it again.

I'm adding it tomorrow.

Labels:

Bond,

Investing,

Mutual Fund,

Non-Retirement

Portfolio Update 11/28/08: Curtains

Last week, I asked for some Help! and we got it. This week saw a nice rebound, but alas it is Curtains for the reign of the WylieMoney 20 Mostly Managed Portfolio as the best performing portfolio in my experiment.

The ETF 20 portfolio pulled ahead, but was unable to beat the WylieMoney Slowly portfolio which had a great week.

This is the second time we've seen a sharp rebound after a steep dive in these weekly updates. Only time will tell if we've hit the bottom.

The ETF 20 portfolio pulled ahead, but was unable to beat the WylieMoney Slowly portfolio which had a great week.

This is the second time we've seen a sharp rebound after a steep dive in these weekly updates. Only time will tell if we've hit the bottom.

Labels:

Investing,

Mutual Fund,

Non-Retirement

Subscribe to:

Posts (Atom)