I discovered

bankdeals.blogspot.com a long time ago. Ken, the author, was one of the first sites to link to mine for which I was very grateful. More importantly, his site is a great resource for researching bank offers of all kinds, all around the country.

For a while I have been watching this site and keeping track of banks that offer much better rates than my own.

After reading chapter one on banking in Russell Bailyn's new book

Navigating the Financial Blogosphere, I was inspired to take a look at how I park my cash and make some changes.

Many online savings accounts offer interest rates that are outperforming all the diversified mutual fund portfolios I have been tracking since May 1st. In reality, the top savings rates 5-5.50% are pretty close to the results of the mutual fund portfolios since the 5% rate is annual and most of the funds are up about 3%. YTD most of the Mutual fund portfolios have earned around 10%, but with a lot of volatility.

But your cash has to sit somewhere and 5% with no risk is not a bad place to park it. I mentioned above that my current bank's rates are not competitive. The truth is that I do not keep much cash there, so my motivation to change has not been great. Let's look at how I manage my cash, why, and the changes I am making.

I currently bank with Citibank. I have my paycheck deposited automatically into my checking account and I maintain a small balance in my savings account. I use yodlee.com to keep track of my bank, investment, retirement, mortgage, and credit card accounts. As paychecks come in and bills come due I pay my bills online and move any leftover cash from Citibank into my Etrade brokerage. I don't do this so I can invest the extra savings, but because cash in my Etrade account earns a

tax free 2.70% APY compared to my Citibank Savings account which earns a

taxable 1.76% APY.

My Citibank account has refunded all ATM fees (in the US anyway) for a long time, which is the main reason I have kept it. I have been able to use any ATM in the USA without worrying about fees. These days, many banks offer this service, so it is worth re-evaluting.

My Etrade brokerage account notes that 2.70% tax free is equivalent to a taxable 3.65% for those in the 35% tax bracket. I am not in that bracket, so my after tax rate is not that high. Since there are many banks offering over 5%, I do not need to worry about my exact after tax earnings. I will make more in a taxable account as long as it earns over 3.65% before taxes and finding a bank that pays that will be easy.

Two other things to note, especially as banks struggle and potentially go out of business. My Etrade Brokerage account is covered by federal insurance up to $500,000. Banks are covered

for up to $100,000 (though not all banks are covered so do your research). Again, I do not have enough money for this to factor in my decision, but if you have over $100,000 you are looking to park somewhere, think about how to spread it around to ensure that it is all covered, in case any given institution goes under. Second, if you are at risk of paying the Alternative Minimum Tax, taking a lower tax free rate may avoid even greater taxes by keeping your adjusted gross income low enough to avoid the AMT. If this is an issue for you, you may want to consult a professional.

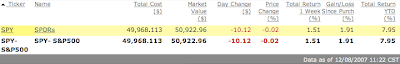

Here are the top deals for savings accounts listed at

bankdeals (12/28/07):

I am not interested in promo rates, though there is no guarantee any of these rates will stay where they are, especially if Ben Bernanke keeps lowering rates over at the Fed. I'm also not interested in a high minimum amount requirement. UFB Direct is interesting at 5.22%, but I am going with Etrade at 5.05% and here is why:

When I transfer funds from Citibank to my Etrade brokerage, the funds take a long time to become available in the Brokerage account. With an Etrade bank account I will be able to transfer funds between my brokerage, retirement and bank account with no delay. Etrade is giving me $25 to sign up (but this offer ends on the 31st so act fast if you want it). Also, there are incentives in both Etrades brokerage and bank account to maintain certain minimum balances for more benefits and to avoid account maintenance fees. If I moved the cash I have in my brokerage to UFB, I might lose some of those benefits or owe fees.

I also set up an Etrade

MaxRate checking account which has a 4.0% APY. I will switch my direct deposit to this account once it is up and running and I have the ATM card and have given everything a test run. This means that even during the brief period my paycheck sits in my checking account before I pay my bills and transfer any savings, I will be earning a higher rate as well.

In summary I was using Citibank checking for ATM fee refunds and transferring savings into my brokerage earning a

tax free 2.70% APY. I am switching to Etrade Max-Rate checking with unlimited ATM fee refunds, and 4.0% taxable APY and will transfer cash savings to Etrade Complete Savings earning 5.05% taxable APY.

Some tips:

- Don't close your old bank until your new one is active and you have used it. If issues arise- your ATM PIN does not work for example, and you have already closed your old account, you will create undue stress for yourself.

- Etrade Max-Rate checking has a fee unless you: 1) Maintain a minimum average balance of $5,000 in your Max-Rate Checking Account 2) Set up and maintain a direct deposit of $200 or more per month (A combination of direct deposits totaling $200 does not satisfy this requirement) 3) Maintain a combined balance of $50,000 or more in linked E*TRADE Securities, E*TRADE Bank, and employee stock plan accounts (including vested in-the-money options, stock option plan shares, ESPP shares, and released restricted stock) accounts 4) Execute at least 30 stock or options trades during a calendar quarter in a linked E*TRADE Securities account.