Each month since May 1st of 2007 I have been adding one fund at a time to a hypothetical portfolio. I am adding funds from one of 20 mutual fund categories in the order I first researched mutual funds for this experiment.

You can read more about this experiment here.

Adding one fund per month is meant to simulate investing over time instead of investing all at once. I picked May 1st as my start date because that was when I was done picking 20 funds to hypothetically invest.

The 10th addition is a Large Cap Value fund. As I add each fund, I take another look at no-load, low minimum investment funds available through Etrade to see if my original pick is still the best available.

In this case, I'm sticking with my original pick:

Large Cap Value - AAGPX American Beacon Lg Cap Val My Post

That means that on the first day the market looks to close sharply down in February, I will add this fund to the WylieMoney Slowly portfolio.

The other two Large Cap Value no-load funds available through Etrade that were worth a look were Bridgeway Large-Cap Value and ING Corporate Leaders Trust.

The Bridgeway fund requires at least $500 for subsequent investments and that is above my minimum. It also has slightly higher turnover than American Beacon Lg Cap Value.

ING Corporate Leaders Trust only holds 23 stocks. It was set up in 1935 and has 0 turnover. As an investment option, it is worth thinking about, but paying even as little as 0.40% for a fund that does nothing is a bit hard to swallow.

That's not really fair- it does let you own 23 companies for less than you would pay in brokerage fees to buy the stocks individually, but for this experiment, I decided to stick to more traditional funds that invest in more companies.

1.31.2008

Portfolio Update 1/25/08: Markets and My Appendix Blow Up

That's right- I missed the weekly update two weeks ago and am late with this one for last week. I was distracted, doubled over in pain as foulness seeped into my gut. I won't go into the details. I had some surgery to remove the agitator and am home recovering.

This post is old news so I won't say much about it. Today the market was up, but Google missed estimates after the bell so we'll see what tomorrow brings...

WylieMoney 20 Mostly Managed holds on to the lead.

This post is old news so I won't say much about it. Today the market was up, but Google missed estimates after the bell so we'll see what tomorrow brings...

WylieMoney 20 Mostly Managed holds on to the lead.

Labels:

Investing,

Mutual Fund,

Non-Retirement

1.14.2008

Go Paperless with Etrade

This year I resolved to focus a little more on being less wasteful. Call it going green. Call it being more efficient. Call it whatever you want.

The bottom line is that everything you do impacts the world in which you live. You will never be aware of most of the impacts. Often the impacts are quite small, individually, and some are good. But many impacts are bad, even in small ways and waste is one thing that is pretty easy to be mindful of and often easy to do something about.

I am one of those kinds of people who actually thumbs through mutual fund prospectuses. Even money market account updates. I don't read them all the way through, but I glance through. So I have never considered it 'wasteful' to get them in the mail.

Truth is, since I have a laptop, it may be more convenient for me to have prospectuses sent to me via email so that I don't have to drag a bunch of paper with me until a good time to read them comes up. And even though I recycle them, it is still a lot of paper that has to be processed for no good reason.

So, I changed my preferences in my Etrade brokerage and IRA accounts. If you use Etrade, you can too and it is easy. I imagine for most brokerages with good online interfaces, it is pretty easy to do. For Etrade, here is exactly how you do it:

Log in.

In the "Accounts" tab, click the "My Info" subtab:

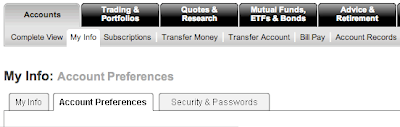

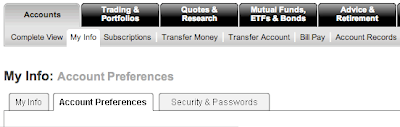

In the "My Info" area, choose the "Account Preferences: tab:

In the "My Info" area, choose the "Account Preferences: tab:

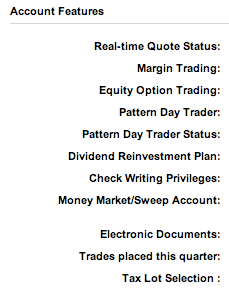

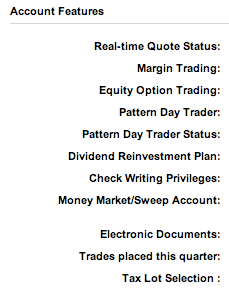

Scroll all the way down to "Account Features" and click the "Edit" link (not shown) next to the option "Electronic Documents:"

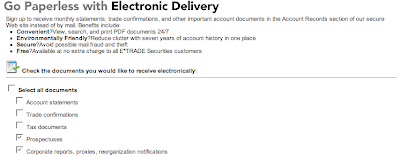

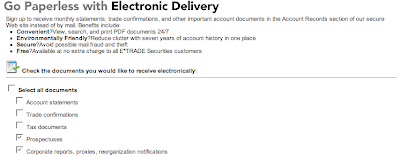

This will bring you to the "Go Paperless..." page. Click on the items you want to receive via email instead of in the mail and then click "Submit" (not shown). you can also change your email address here.

This will bring you to the "Go Paperless..." page. Click on the items you want to receive via email instead of in the mail and then click "Submit" (not shown). you can also change your email address here.

That's all there is to it.

I opted to still receive paper copies of account statements, trade confirmations, and tax documents as I file and save all of these. Read here to find out why.

The bottom line is that everything you do impacts the world in which you live. You will never be aware of most of the impacts. Often the impacts are quite small, individually, and some are good. But many impacts are bad, even in small ways and waste is one thing that is pretty easy to be mindful of and often easy to do something about.

I am one of those kinds of people who actually thumbs through mutual fund prospectuses. Even money market account updates. I don't read them all the way through, but I glance through. So I have never considered it 'wasteful' to get them in the mail.

Truth is, since I have a laptop, it may be more convenient for me to have prospectuses sent to me via email so that I don't have to drag a bunch of paper with me until a good time to read them comes up. And even though I recycle them, it is still a lot of paper that has to be processed for no good reason.

So, I changed my preferences in my Etrade brokerage and IRA accounts. If you use Etrade, you can too and it is easy. I imagine for most brokerages with good online interfaces, it is pretty easy to do. For Etrade, here is exactly how you do it:

Log in.

In the "Accounts" tab, click the "My Info" subtab:

In the "My Info" area, choose the "Account Preferences: tab:

In the "My Info" area, choose the "Account Preferences: tab:

Scroll all the way down to "Account Features" and click the "Edit" link (not shown) next to the option "Electronic Documents:"

This will bring you to the "Go Paperless..." page. Click on the items you want to receive via email instead of in the mail and then click "Submit" (not shown). you can also change your email address here.

This will bring you to the "Go Paperless..." page. Click on the items you want to receive via email instead of in the mail and then click "Submit" (not shown). you can also change your email address here.

That's all there is to it.

I opted to still receive paper copies of account statements, trade confirmations, and tax documents as I file and save all of these. Read here to find out why.

Labels:

Brokerage,

Etrade,

Mutual Fund,

Random,

Resources

1.13.2008

Portfolio Update 1/11/08: Everybody Hurts...

...sometimes.

Well, had I actually invested $50,000 on May 1st 2007, in any one of these portfolios, I would have lost money.

Year to Date, the ETF portfolio has done better than several portfolios that are ahead of it, though this week it struggled a bit. The Three Fund Index has done best year to date, but had the worst week last week, leaving the WylieMoney 20 Mostly Managed portfolio alone in first place, with about $125 loss. Had I not hypothetically diversified across categories but simply dumped all my imaginary money in an index fund that tracks the S&P 500, I would be sitting on a $2500 loss!

Well, had I actually invested $50,000 on May 1st 2007, in any one of these portfolios, I would have lost money.

Year to Date, the ETF portfolio has done better than several portfolios that are ahead of it, though this week it struggled a bit. The Three Fund Index has done best year to date, but had the worst week last week, leaving the WylieMoney 20 Mostly Managed portfolio alone in first place, with about $125 loss. Had I not hypothetically diversified across categories but simply dumped all my imaginary money in an index fund that tracks the S&P 500, I would be sitting on a $2500 loss!

Labels:

Investing,

Mutual Fund,

Non-Retirement

1.08.2008

Reinvesting dividends and capital gains in a taxable account

Up until now, I had all my mutual fund dividends and capital gains distributions set to automatically reinvest in my taxable brokerage account.

This creates a bit of work when it comes to calculating the basis on my holdings when I sell a fund, but I don't mind. And with online brokerages, it is not much work at all. Etrade keeps track of the basis and I assume other brokerages do too. So as long as I note the basis before I sell and the holding no longer shows in my portfolio, and the records are accurate for holdings I bought before I started using Etrade, there is no work to do at all.

There are four reasons I turned off automatic dividend reinvesting, anyway:

1) If you sell a no-load no-fee fund within 90 days of purchase you are penalized a fee of $49.99. I do not know that this applies to automatic reinvestments (I assume it does), but I'd rather not worry or risk the hassle.

2) If I think I want to sell a fund, I typically don't add anything to it for a year before I sell so any gains are taxed as long term gains. I have two funds I have not been adding to since last June, thinking I might sell after my last addition to the funds is a year ago or greater. In December the funds distributed and reinvested automatically. This complicates the tax implications of a sale unless I now wait until next December which has slightly agitated my calm.

3) I invest regularly adding small amounts to some holdings to keep my overall portfolio balanced as I want it. Taking gains and distributions as cash and manually adding them to the funds I want to gives me more control over keeping my overall portfolio in balance. For some people (those who would let the cash sit) this might not be a good idea, but I have seen that I regularly take the cash I save in my brokerage and invest it, so this should work well for me.

4) Even though Etrade keeps good records of all my purchases, when Etrade bought my previous brokerage, the old electronic details did not convert over. I assume if Etrade goes under or another firm buys Etrade, or I end up with a new brokerage for any reason, the balances will transfer but the details about my basis will not. Sure I can keep track of everything myself, but to do so is more hassle than it is worth.

If you have an Etrade account that is not a retirement account, or even if it is a retirement account, and you want to un-enroll from automatic reinvesting, simply go to the online service center and type in a request to customer service for them to make the change. For mutual funds, you cannot do it yourself through their interface.

I left my Roth IRA alone so it still automatically reinvests. Since I only add to the IRA once a year, and I cannot add enough to rebalance all the holdings by adding to the market sectors that trailed the year before, and I don't have enough in the IRA for the dividends and distributions to be significant, and the IRA is not taxed like a non-retirement account, it make sense to me to allow the dividends to reinvest.

On an unrelated note, check out the Coyote I saw romping around in the snow in my driveway the other day!

This creates a bit of work when it comes to calculating the basis on my holdings when I sell a fund, but I don't mind. And with online brokerages, it is not much work at all. Etrade keeps track of the basis and I assume other brokerages do too. So as long as I note the basis before I sell and the holding no longer shows in my portfolio, and the records are accurate for holdings I bought before I started using Etrade, there is no work to do at all.

There are four reasons I turned off automatic dividend reinvesting, anyway:

1) If you sell a no-load no-fee fund within 90 days of purchase you are penalized a fee of $49.99. I do not know that this applies to automatic reinvestments (I assume it does), but I'd rather not worry or risk the hassle.

2) If I think I want to sell a fund, I typically don't add anything to it for a year before I sell so any gains are taxed as long term gains. I have two funds I have not been adding to since last June, thinking I might sell after my last addition to the funds is a year ago or greater. In December the funds distributed and reinvested automatically. This complicates the tax implications of a sale unless I now wait until next December which has slightly agitated my calm.

3) I invest regularly adding small amounts to some holdings to keep my overall portfolio balanced as I want it. Taking gains and distributions as cash and manually adding them to the funds I want to gives me more control over keeping my overall portfolio in balance. For some people (those who would let the cash sit) this might not be a good idea, but I have seen that I regularly take the cash I save in my brokerage and invest it, so this should work well for me.

4) Even though Etrade keeps good records of all my purchases, when Etrade bought my previous brokerage, the old electronic details did not convert over. I assume if Etrade goes under or another firm buys Etrade, or I end up with a new brokerage for any reason, the balances will transfer but the details about my basis will not. Sure I can keep track of everything myself, but to do so is more hassle than it is worth.

If you have an Etrade account that is not a retirement account, or even if it is a retirement account, and you want to un-enroll from automatic reinvesting, simply go to the online service center and type in a request to customer service for them to make the change. For mutual funds, you cannot do it yourself through their interface.

I left my Roth IRA alone so it still automatically reinvests. Since I only add to the IRA once a year, and I cannot add enough to rebalance all the holdings by adding to the market sectors that trailed the year before, and I don't have enough in the IRA for the dividends and distributions to be significant, and the IRA is not taxed like a non-retirement account, it make sense to me to allow the dividends to reinvest.

On an unrelated note, check out the Coyote I saw romping around in the snow in my driveway the other day!

Labels:

Brokerage,

Capital Gains,

Investing,

Mutual Fund,

Non-Retirement,

Resources,

Taxes,

Timing

1.06.2008

Portfolio Update 1/04/08: Ouch!

Ouch.

Last week was ugly.

Only one of the hypothetical portfolios I track is still up since purchase on May 1st 2007, the WylieMoney 20 Mostly Managed portfolio.

Over the long term, having a diverse portfolio has paid off. The S&P 500 portfolio is down over 4% while the second worst performer, the ETF 20 is only down 2.37%.

Over the long term, having a diverse portfolio has paid off. The S&P 500 portfolio is down over 4% while the second worst performer, the ETF 20 is only down 2.37%.

Last week was brutal across the board with every portfolio down over 2.75%. Bonds were the winners, but none of the portfolios has more than 15% in bonds.

Adding a real estate fund to the WylieMoney slowly portfolio gave that portfolio the worst YTD record as the SSREX promptly lost 7.31%.

Ouch.

Last week was ugly.

Only one of the hypothetical portfolios I track is still up since purchase on May 1st 2007, the WylieMoney 20 Mostly Managed portfolio.

Over the long term, having a diverse portfolio has paid off. The S&P 500 portfolio is down over 4% while the second worst performer, the ETF 20 is only down 2.37%.

Over the long term, having a diverse portfolio has paid off. The S&P 500 portfolio is down over 4% while the second worst performer, the ETF 20 is only down 2.37%.Last week was brutal across the board with every portfolio down over 2.75%. Bonds were the winners, but none of the portfolios has more than 15% in bonds.

Adding a real estate fund to the WylieMoney slowly portfolio gave that portfolio the worst YTD record as the SSREX promptly lost 7.31%.

Ouch.

Labels:

Investing,

Mutual Fund,

Non-Retirement

1.05.2008

What is an ETN?

I recently rounded up a bunch of securities that invest in food and finance. The securities that invest in financial stocks are ETFs. Some of the securities I found that track food are ETNs which I was not as familiar with.

The best article I found defining ETNs is here. A gross simplification is that an ETN is like a bond that pays no interest whose value is based on the index it tracks. Since an ETN does not actually invest in the index, like an ETF does, its value is closer to the index than an ETF since the ETF has to buy and sell securities to stay in sync with the index.

ETNs are very new and there is a lot about them that is up in the air. So if you foolishly decide to speculate on food prices, not only will you be speculating on the value of the underlying commodities (Or diversifying, if that is what you are up to...hehe), you will be speculating on the security itself.

When you buy an ETF, you are buying fractional shares of the underlying security. If the company that offers the ETF goes kerplunk, you still own the fraction shares and can presumably get your money back. ETNs are Exchange Traded Notes offered by a bank. If the bank goes kerplunk, there is no guarantee there will be funds on hand to pay you back. Of course only giant banks are offering these, but these are the same giant banks writing off billions in bad debt from other new securities they mishandled.

How ETNs should be taxed is also under question. Marketwatch ran a recent article worth reading. Since you own a note and not a fractional share of a security, you are not being paid dividends from that security if it actually pays them (for the record, corn does not currently pay a dividend though it does pop if heated up properly). If you are not paid a dividend, you do not owe taxes on it.

I confess, I do not have a thorough understanding of how ETNs really work from top to bottom and I have not found any articles that appear confident of how ETNs will be taxed in the future and there is some risk that if the IRS decides to tax ETNs unfavorably, the change may be retroactive.

Will the IRS go after ETNs? If you want a glimpse of the politics behind such questions read here.

The best article I found defining ETNs is here. A gross simplification is that an ETN is like a bond that pays no interest whose value is based on the index it tracks. Since an ETN does not actually invest in the index, like an ETF does, its value is closer to the index than an ETF since the ETF has to buy and sell securities to stay in sync with the index.

ETNs are very new and there is a lot about them that is up in the air. So if you foolishly decide to speculate on food prices, not only will you be speculating on the value of the underlying commodities (Or diversifying, if that is what you are up to...hehe), you will be speculating on the security itself.

When you buy an ETF, you are buying fractional shares of the underlying security. If the company that offers the ETF goes kerplunk, you still own the fraction shares and can presumably get your money back. ETNs are Exchange Traded Notes offered by a bank. If the bank goes kerplunk, there is no guarantee there will be funds on hand to pay you back. Of course only giant banks are offering these, but these are the same giant banks writing off billions in bad debt from other new securities they mishandled.

How ETNs should be taxed is also under question. Marketwatch ran a recent article worth reading. Since you own a note and not a fractional share of a security, you are not being paid dividends from that security if it actually pays them (for the record, corn does not currently pay a dividend though it does pop if heated up properly). If you are not paid a dividend, you do not owe taxes on it.

I confess, I do not have a thorough understanding of how ETNs really work from top to bottom and I have not found any articles that appear confident of how ETNs will be taxed in the future and there is some risk that if the IRS decides to tax ETNs unfavorably, the change may be retroactive.

Will the IRS go after ETNs? If you want a glimpse of the politics behind such questions read here.

1.04.2008

2007 Portfolio Update: Mostly Managed Portfolio Outperforms

From the beginning of my experiment with 6 hypothetical portfolios, through the end of 2007, the WylieMoney 20 Mostly Managed portfolio of 20 mutual funds I hand picked, all available through a single brokerage, all with no loads or fees each available for an initial purchase of $2500 or less allowing $100 or less subsequent additions, was the clear victor.

The WylieMoney 20 portfolio beat a portfolio of 3 Vanguard index funds matching its coverage of domestic stocks, international stocks and bonds by over 1%. It did this, despite the fact that one of the funds in the WylieMoney portfolio was a real estate fund which was down 17.59% while the 3 fund Vanguard index portfolio had no comparable real estate exposure.

Comparing a portfolio of 20 Vanguard funds against the WylieMoney 20 portfolio category by category, showed the WylieMoney approach even more successful with WylieMoney beating Vanguard over 2%. Not bad for 2 equally weighted portfolios in less than a year.

I set these up as hypothetical non-retirement accounts. The minimum purchase amounts for mutual funds are often different for retirement vs non-retirement accounts. Also, non-retirement accounts are taxed annually so taxes owed as a result capital gains distributions can eat into performance.

I have not come up with a good way to account for the hypothetical tax impact of these funds. The "Tax Cost Ratio 3 Year %" for the WylieMoney portfolio is 1%. For the 3 Fund Index, the 3 Year Tax Cost ratio is 0.57%. If this were the actual tax cost for 2007, WylieMoney would still be the clear victor.

Those of you who own a number of mutual funds and saw the sizable capital gains distributions made this November and December have good reason to suspect that this year's tax bill will be much higher than the previous 3 years. My understanding is that the major reason for this is that 2004-2006 saw significant capital gains, but fund managers were, on the whole, able to offset gains with losses from 2001-2003. Into 2007, the gains were still strong, YTD the diversified portfolios earned 8-12%, but there were no more losses on the books to offset the gains, thus the distributions.

So even though the WylieMoney portfolio is in the lead, the three fund portfolio is well worth watching, both for its tax advantage and its simplicity.

The 3 Year Tax Cost Ratio% of the Lazy 20 Mostly Index portfolio was 0.8%, much closer to the Mostly Managed portfolio.

The WylieMoney 20 portfolio beat a portfolio of 3 Vanguard index funds matching its coverage of domestic stocks, international stocks and bonds by over 1%. It did this, despite the fact that one of the funds in the WylieMoney portfolio was a real estate fund which was down 17.59% while the 3 fund Vanguard index portfolio had no comparable real estate exposure.

Comparing a portfolio of 20 Vanguard funds against the WylieMoney 20 portfolio category by category, showed the WylieMoney approach even more successful with WylieMoney beating Vanguard over 2%. Not bad for 2 equally weighted portfolios in less than a year.

I set these up as hypothetical non-retirement accounts. The minimum purchase amounts for mutual funds are often different for retirement vs non-retirement accounts. Also, non-retirement accounts are taxed annually so taxes owed as a result capital gains distributions can eat into performance.

I have not come up with a good way to account for the hypothetical tax impact of these funds. The "Tax Cost Ratio 3 Year %" for the WylieMoney portfolio is 1%. For the 3 Fund Index, the 3 Year Tax Cost ratio is 0.57%. If this were the actual tax cost for 2007, WylieMoney would still be the clear victor.

Those of you who own a number of mutual funds and saw the sizable capital gains distributions made this November and December have good reason to suspect that this year's tax bill will be much higher than the previous 3 years. My understanding is that the major reason for this is that 2004-2006 saw significant capital gains, but fund managers were, on the whole, able to offset gains with losses from 2001-2003. Into 2007, the gains were still strong, YTD the diversified portfolios earned 8-12%, but there were no more losses on the books to offset the gains, thus the distributions.

So even though the WylieMoney portfolio is in the lead, the three fund portfolio is well worth watching, both for its tax advantage and its simplicity.

The 3 Year Tax Cost Ratio% of the Lazy 20 Mostly Index portfolio was 0.8%, much closer to the Mostly Managed portfolio.

Labels:

Investing,

Mutual Fund,

Non-Retirement

1.02.2008

Next pick for WylieMoney Slowly is Real Estate!

That's right, Real Estate!

If you want to invest in what's hot, like I said before, buy some corn:

For the WylieMoney Slowly portfolio, I am adding one fund per month in the order I originally researched each of the 20 categories I picked. This month is Real Estate. Plus, buying low is half the battle, right?

A quick glance at Etrade for no-load, inexpensive Real Estate funds confirms that SSgA T. Act. REIT - SSREX is still the best fund available (My Post).

Just to reiterate, I am not advising anyone go out and buy a Real Estate fund for a taxable (non-retirement) account. I am tracking the performance of hypothetical accounts and trying to learn a thing or two about mutual fund investing strategies along the way. I do actually own a Real Estate fund in a taxable account and I can confirm that it is taxed higher than standard mutual funds and getting accurate tax information about it holds up my taxes every year so it is a headache and a half.

Regardless, today is the day I'll add the Real Estate fund.

If you want to invest in what's hot, like I said before, buy some corn:

For the WylieMoney Slowly portfolio, I am adding one fund per month in the order I originally researched each of the 20 categories I picked. This month is Real Estate. Plus, buying low is half the battle, right?

A quick glance at Etrade for no-load, inexpensive Real Estate funds confirms that SSgA T. Act. REIT - SSREX is still the best fund available (My Post).

Just to reiterate, I am not advising anyone go out and buy a Real Estate fund for a taxable (non-retirement) account. I am tracking the performance of hypothetical accounts and trying to learn a thing or two about mutual fund investing strategies along the way. I do actually own a Real Estate fund in a taxable account and I can confirm that it is taxed higher than standard mutual funds and getting accurate tax information about it holds up my taxes every year so it is a headache and a half.

Regardless, today is the day I'll add the Real Estate fund.

Labels:

Investing,

Mutual Fund,

Non-Retirement,

Real Estate,

Taxes

Subscribe to:

Posts (Atom)