Using the Mutual fund Screener to identify No-Load, No-Fee funds with a Style: ‘Equity Mid Cap Blend,’ I find 18 options. I start by finding the average turnover rate: 76.87% and expense ratio 1.20% of funds in this category. Then I look at the Funds sorted by best 5 year annual performance and look for funds with $3000 or lower initial purchase minimum and $100 subsequent investment minimum and turnover and expenses equal to or lower than the minimum. I will also check whether they are consistently investing in mid cap companies. All these details are as of 11/12/06.

The first funds listed have done well but I rule them out for these reasons:

UMPIX ProFunds: UltraMid Cap/Inv has a really high 402.00% portfolio turnover, and a $15,000 initial minimum purchase as well as a 1.49% expense ratio.

ASMCX Accessor Funds: Small to Mid Cap/Adv has a $1,000 minimum for subsequent investment. Also this fund splits between mid and small cap companies and following this plan, we will select a separate fund covering small cap companies.

RIMSX Rainier Investment: Sm/Md Cap Eqty Port has a $25,000 initial min, $1,000 Subsequent min. In addition, it has a significant portion of its holdings in small cap companies.

ACSIX Accessor Funds: Small to Mid Cap/Inv has a $5,000 initial min. which is a little higher than I want but $1,000 Subsequent min. is much too high. The 1.64% expense ration is also above average and again, some of the recent out-performance is due to investing in small cap companies which have done well recently.

The next three funds listed:

CHTTX ABN AMRO Mid Cap Fund/N has very low portfolio turnover 27.42%, average expense ratio of 1.23%, and $2,500 and $50 initial and subsequent minimums. This is a definite candidate.

PESPX Dreyfus Index Fds: Midcap Index Fund has $2,500 and $100 initial and subsequent minimums, a 0.50% Expense Ratio and a low 19.54% turnover rate. Another candidate.

NTIAX Columbia Mid Cap Index Fund/A has $1,000 and $100 initial and subsequent minimums, a 0.39 Expense Ratio and a low 24.00% turnover rate. A third candidate.

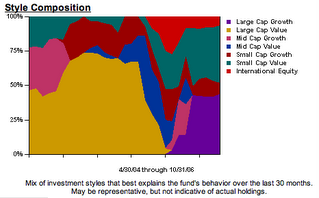

In looking at CHTTX, I immediatley notice that it is investing a great deal in stocks of companies other than mid cap domestic companies. As you can see by this graphic:

Basically there are no managed funds that meet the criteria for my portfolio in the Mid Cap Blend style, but there are 2 index funds that do. Either PESPX or NTIAX would be a good option- both have low turnover rates and low expenses, as you would expect with index funds. There is one big difference PESPX has 2,269.3 million under management compared to 37.7 million for NTIAX. This could explain why the expenses on NTIAX are a little bit lower. NTIAX has slightly lower expenses and has ever so slightly out-performed PESPX over the 3 year and one year periods, so I will go with NTIAX.

When looking at funds available through Etrade, a fund available for a transaction fee (meaning it would not be a candidate for investing additional $100 contributions over time) VIMSX Vanguard Mid Cap Index/Inv has an even lower 0.22% expense ratio, and a low 18.00% portfolio turnover. There are a few other funds that have performed a bit better than this index fund, but they have 1% or more higher annual expense ratios and are investing in many sectors other than domestic mid cap companies. In addition to being cheaper, VIMSX has outperformed NTIAX, so it is too bad that it is not available for no fee.

No comments:

Post a Comment