The next recommendation for this hypothetical non-retirement account is a Global Equity fund or World Stock. This is an international fund that has a large US component and generally also invests some in emerging markets.

Since I am building a portfolio that could be built in this specific order, I picked a blend category first and this broad category second. I think international exposure is good for diversifying, but owning only an emerging markets fund or specific overseas category along with only a domestic Mid Cap Blend, would be pretty narrow, so World Stock it is.

The average turnover for funds in this category is 58.25% and the average expense ratio is 1.45%. Searching through the offerings and looking at the criteria I care about, I find 5 that look promising but quickly note that 2 are closed to new investors (OAKGX, SCOBX). A third (BJGQX) has $1000 minimum for subsequent investments and an above average expense ratio so despite a good track record, I rule it out.

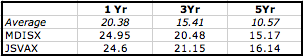

That leaves only two options, but they are among the top performers, have $100 minimum for subsequent investments and lower than average turnover and expenses. MDISX Mutual Discovery Fund/Z and JSVAX Janus Contrarian Fund have both performed really well over the last 5 years, 3 years, 1 year and YTD. This is good reason to pause and wonder if these funds are not due to slow down or pull back. Since our proposed portfolio will invest over time, we have reduced the risk a down-turn poses and the average Price to earning ratio of stocks held in these funds is not too high (13.4 for MDISX and 17.5 for JSVAX according to Morningstar) so the holdings do not seem overpriced, on average.

Here is a breakdown:

Portfolio Turnover (Average 58.25%)

*MDISX 25.69%

JSVAX 42.00%

Expense Ratio (Average 1.45%)

MDISX 1.04%

*JSVAX 0.93%

Performance

So MDISX has much lower turnover which could help keep capital gains tax low. It has a slightly higher expense ratio, but only by 0.11% It has performed about the same, but slightly better recently than JSVAX. For those reasons and because I anticipate I will pick some Janus funds when looking at Domestic Growth stocks, and I want to pick from different fund companies if I find good options, my pick here is MDISX.

5 comments:

How do you feel about MDISX now? Has your opinion changed?

Howdy Anonymous!

My opinion has not changed. MDISX is still outperforming funds in the same category, expenses are still low and turnover is a relatively low 25% which is good for a taxable account.

It is down over 10% this year, which could be why you are asking, but if you are looking for a Global Equity fund with low minimum initial and subsequent investment amounts, this fund still looks good to me.

This fund seems to have held up well compared to other international stock funds. Ten yr return = 11.57%, 5 yr return = 12.39%, Return over life of fund = 13.64%. I tried to purchase some through my 401K plan but was told the fund is closed to new investors. Funny, couldn't find anything on the Franklin Templeton website that suggested this.

Hi Dibbler,

I do not see any indication that this fund closed, but it did bump its minimum initial investment from less than $2500 to $50,000 which essentially closes it to most individual investors.

I think your 401k provider gave you bad info, but it may not be a fund they are willing to offer for other reasons.

I have this fund since 1990s , the z class share is closed for new investor, but you can still buy the class A share. I have this fund in my Roth, and 401K, it may not be zooming like others but it sure did better in the bear market

Post a Comment