Wells Fargo has a page that goes into some detail about what a fund category means and the risks typically associated with each category.

I think Wells Fargo's page is much clearer than Morningstar's own explanations. Maybe Morningstar has a better page somewhere, but I don't see it...

11.26.2006

Non-Ret: Bond Gov. Long

My Pick: BTTRX American Century Target Maturity 2025/Inv

The first two funds picked, Mid Cap Blend and Global Equity, might be deemed by some as riskier than the typical stock pick. To further diversify, and hopefully offset some of the risk, the next fund I will add to this hypothetical portfolio will be a bond fund. By picking Government bonds, credit risks are reduced. Besides, if the US defaults on its debt, we will likely have more pressing concerns than the performance of this particular fund. Also, since we added a solid international funds, as money pours out US securities, it should poor into the Global fund we picked. Well, it might. Anyway, bonds with longer duration tend to react more to changes in interest rates, so this is not the least risky bond fund category.

So, I pull up no-load, no fees and sort by 3 year performance. BTTRX comes up as the top performer by a good margin over 10, 5 and 3 year ranges. It has slightly underperformed BTTTX over the last year and is actually down slightly for the year, but not by much and BTTTX is only up 0.83%.

There are no other funds in this category that I like. The one downside to these funds is that the minimum initial investment is $2500, compared to $1000 for each of our first two picks. So I checked and all the other funds in this category that have performed decently have a $2500 initial investment or higher

Expenses are the exact same, but BTTRX has a 26% turnover rate compared to BTTTX at 10%. Both funds are managed by the same manager and team (Jeremy Fletcher).

Either option would work as expenses, turnover, performance are all relatively close. In this case, I am choosing the fund with the better long term performance record: BTTRX. Searching for all funds available in this category through Etrade, these are still the best options, so even if you are not looking to contribute additional small amounts, these are worth considering if you are looking for a Long Term Government Bond mutual fund.

The first two funds picked, Mid Cap Blend and Global Equity, might be deemed by some as riskier than the typical stock pick. To further diversify, and hopefully offset some of the risk, the next fund I will add to this hypothetical portfolio will be a bond fund. By picking Government bonds, credit risks are reduced. Besides, if the US defaults on its debt, we will likely have more pressing concerns than the performance of this particular fund. Also, since we added a solid international funds, as money pours out US securities, it should poor into the Global fund we picked. Well, it might. Anyway, bonds with longer duration tend to react more to changes in interest rates, so this is not the least risky bond fund category.

So, I pull up no-load, no fees and sort by 3 year performance. BTTRX comes up as the top performer by a good margin over 10, 5 and 3 year ranges. It has slightly underperformed BTTTX over the last year and is actually down slightly for the year, but not by much and BTTTX is only up 0.83%.

There are no other funds in this category that I like. The one downside to these funds is that the minimum initial investment is $2500, compared to $1000 for each of our first two picks. So I checked and all the other funds in this category that have performed decently have a $2500 initial investment or higher

Expenses are the exact same, but BTTRX has a 26% turnover rate compared to BTTTX at 10%. Both funds are managed by the same manager and team (Jeremy Fletcher).

Either option would work as expenses, turnover, performance are all relatively close. In this case, I am choosing the fund with the better long term performance record: BTTRX. Searching for all funds available in this category through Etrade, these are still the best options, so even if you are not looking to contribute additional small amounts, these are worth considering if you are looking for a Long Term Government Bond mutual fund.

11.22.2006

11.20.2006

Non-Ret: Global Equity

My pick: MDISX Mutual Discovery Fund/Z

The next recommendation for this hypothetical non-retirement account is a Global Equity fund or World Stock. This is an international fund that has a large US component and generally also invests some in emerging markets.

Since I am building a portfolio that could be built in this specific order, I picked a blend category first and this broad category second. I think international exposure is good for diversifying, but owning only an emerging markets fund or specific overseas category along with only a domestic Mid Cap Blend, would be pretty narrow, so World Stock it is.

The average turnover for funds in this category is 58.25% and the average expense ratio is 1.45%. Searching through the offerings and looking at the criteria I care about, I find 5 that look promising but quickly note that 2 are closed to new investors (OAKGX, SCOBX). A third (BJGQX) has $1000 minimum for subsequent investments and an above average expense ratio so despite a good track record, I rule it out.

That leaves only two options, but they are among the top performers, have $100 minimum for subsequent investments and lower than average turnover and expenses. MDISX Mutual Discovery Fund/Z and JSVAX Janus Contrarian Fund have both performed really well over the last 5 years, 3 years, 1 year and YTD. This is good reason to pause and wonder if these funds are not due to slow down or pull back. Since our proposed portfolio will invest over time, we have reduced the risk a down-turn poses and the average Price to earning ratio of stocks held in these funds is not too high (13.4 for MDISX and 17.5 for JSVAX according to Morningstar) so the holdings do not seem overpriced, on average.

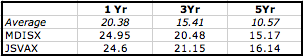

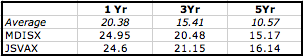

Here is a breakdown:

Portfolio Turnover (Average 58.25%)

*MDISX 25.69%

JSVAX 42.00%

Expense Ratio (Average 1.45%)

MDISX 1.04%

*JSVAX 0.93%

Performance

So MDISX has much lower turnover which could help keep capital gains tax low. It has a slightly higher expense ratio, but only by 0.11% It has performed about the same, but slightly better recently than JSVAX. For those reasons and because I anticipate I will pick some Janus funds when looking at Domestic Growth stocks, and I want to pick from different fund companies if I find good options, my pick here is MDISX.

The next recommendation for this hypothetical non-retirement account is a Global Equity fund or World Stock. This is an international fund that has a large US component and generally also invests some in emerging markets.

Since I am building a portfolio that could be built in this specific order, I picked a blend category first and this broad category second. I think international exposure is good for diversifying, but owning only an emerging markets fund or specific overseas category along with only a domestic Mid Cap Blend, would be pretty narrow, so World Stock it is.

The average turnover for funds in this category is 58.25% and the average expense ratio is 1.45%. Searching through the offerings and looking at the criteria I care about, I find 5 that look promising but quickly note that 2 are closed to new investors (OAKGX, SCOBX). A third (BJGQX) has $1000 minimum for subsequent investments and an above average expense ratio so despite a good track record, I rule it out.

That leaves only two options, but they are among the top performers, have $100 minimum for subsequent investments and lower than average turnover and expenses. MDISX Mutual Discovery Fund/Z and JSVAX Janus Contrarian Fund have both performed really well over the last 5 years, 3 years, 1 year and YTD. This is good reason to pause and wonder if these funds are not due to slow down or pull back. Since our proposed portfolio will invest over time, we have reduced the risk a down-turn poses and the average Price to earning ratio of stocks held in these funds is not too high (13.4 for MDISX and 17.5 for JSVAX according to Morningstar) so the holdings do not seem overpriced, on average.

Here is a breakdown:

Portfolio Turnover (Average 58.25%)

*MDISX 25.69%

JSVAX 42.00%

Expense Ratio (Average 1.45%)

MDISX 1.04%

*JSVAX 0.93%

Performance

So MDISX has much lower turnover which could help keep capital gains tax low. It has a slightly higher expense ratio, but only by 0.11% It has performed about the same, but slightly better recently than JSVAX. For those reasons and because I anticipate I will pick some Janus funds when looking at Domestic Growth stocks, and I want to pick from different fund companies if I find good options, my pick here is MDISX.

11.14.2006

Etrade: Mutual fund offerings

I would avoid using a brokerage that only offers funds of one company. Putnam, Janus, Fidelity etc. To better diversify, it is important to pick funds from different companies as well as from different sectors. Even though funds at one company may have different managers and focus on different market sectors, sometimes they use the same pool of analysts so funds covering ‘different’ market sectors may end up holding the same companies resulting in a less diverse portfolio. Besides, I am not aware of one fund company that covers all the sectors I want to cover and also beats the averages of funds covering those sectors, in every case. If any of you know about one, let me know!

As mentioned before, I will use Etrade for this hypothetical portfolio, but other brokerage may offer the tools to set up a similar plan. Motley Fool's website has a comparison of a few brokerages and Dogs of the Dow's site offers more information including customer feedback.

Etrade offers funds from many families and most critical to the wealth building scheme I propose to develop, it offers many no-load funds available for purchase for no fee (It advertises over 1000 of these). One family of funds I like to keep an eye on that is not well represented at Etrade currently is Artisan.

A search for no-load, no-fee funds finds 1158, but some of these are closed to new investors and some have minimum initial investments of $1 million or more, so the actual number of open no-load no-fee funds with minimum investment amounts of say $5000 or less is not clear. It would be nice if the fund screener tool let you exclude funds with high minimum investments or that are closed to new investors, but it does not.

As mentioned before, I will use Etrade for this hypothetical portfolio, but other brokerage may offer the tools to set up a similar plan. Motley Fool's website has a comparison of a few brokerages and Dogs of the Dow's site offers more information including customer feedback.

Etrade offers funds from many families and most critical to the wealth building scheme I propose to develop, it offers many no-load funds available for purchase for no fee (It advertises over 1000 of these). One family of funds I like to keep an eye on that is not well represented at Etrade currently is Artisan.

A search for no-load, no-fee funds finds 1158, but some of these are closed to new investors and some have minimum initial investments of $1 million or more, so the actual number of open no-load no-fee funds with minimum investment amounts of say $5000 or less is not clear. It would be nice if the fund screener tool let you exclude funds with high minimum investments or that are closed to new investors, but it does not.

11.12.2006

Non-Ret: Mid Cap Blend

My pick: NTIAX Columbia Mid Cap Index Fund/A

Using the Mutual fund Screener to identify No-Load, No-Fee funds with a Style: ‘Equity Mid Cap Blend,’ I find 18 options. I start by finding the average turnover rate: 76.87% and expense ratio 1.20% of funds in this category. Then I look at the Funds sorted by best 5 year annual performance and look for funds with $3000 or lower initial purchase minimum and $100 subsequent investment minimum and turnover and expenses equal to or lower than the minimum. I will also check whether they are consistently investing in mid cap companies. All these details are as of 11/12/06.

The first funds listed have done well but I rule them out for these reasons:

UMPIX ProFunds: UltraMid Cap/Inv has a really high 402.00% portfolio turnover, and a $15,000 initial minimum purchase as well as a 1.49% expense ratio.

ASMCX Accessor Funds: Small to Mid Cap/Adv has a $1,000 minimum for subsequent investment. Also this fund splits between mid and small cap companies and following this plan, we will select a separate fund covering small cap companies.

RIMSX Rainier Investment: Sm/Md Cap Eqty Port has a $25,000 initial min, $1,000 Subsequent min. In addition, it has a significant portion of its holdings in small cap companies.

ACSIX Accessor Funds: Small to Mid Cap/Inv has a $5,000 initial min. which is a little higher than I want but $1,000 Subsequent min. is much too high. The 1.64% expense ration is also above average and again, some of the recent out-performance is due to investing in small cap companies which have done well recently.

The next three funds listed:

CHTTX ABN AMRO Mid Cap Fund/N has very low portfolio turnover 27.42%, average expense ratio of 1.23%, and $2,500 and $50 initial and subsequent minimums. This is a definite candidate.

PESPX Dreyfus Index Fds: Midcap Index Fund has $2,500 and $100 initial and subsequent minimums, a 0.50% Expense Ratio and a low 19.54% turnover rate. Another candidate.

NTIAX Columbia Mid Cap Index Fund/A has $1,000 and $100 initial and subsequent minimums, a 0.39 Expense Ratio and a low 24.00% turnover rate. A third candidate.

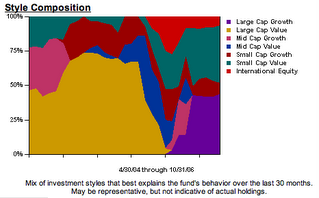

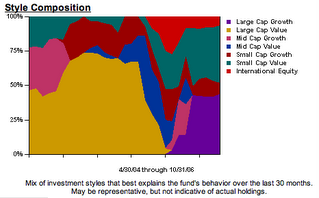

In looking at CHTTX, I immediatley notice that it is investing a great deal in stocks of companies other than mid cap domestic companies. As you can see by this graphic:

Basically there are no managed funds that meet the criteria for my portfolio in the Mid Cap Blend style, but there are 2 index funds that do. Either PESPX or NTIAX would be a good option- both have low turnover rates and low expenses, as you would expect with index funds. There is one big difference PESPX has 2,269.3 million under management compared to 37.7 million for NTIAX. This could explain why the expenses on NTIAX are a little bit lower. NTIAX has slightly lower expenses and has ever so slightly out-performed PESPX over the 3 year and one year periods, so I will go with NTIAX.

When looking at funds available through Etrade, a fund available for a transaction fee (meaning it would not be a candidate for investing additional $100 contributions over time) VIMSX Vanguard Mid Cap Index/Inv has an even lower 0.22% expense ratio, and a low 18.00% portfolio turnover. There are a few other funds that have performed a bit better than this index fund, but they have 1% or more higher annual expense ratios and are investing in many sectors other than domestic mid cap companies. In addition to being cheaper, VIMSX has outperformed NTIAX, so it is too bad that it is not available for no fee.

Using the Mutual fund Screener to identify No-Load, No-Fee funds with a Style: ‘Equity Mid Cap Blend,’ I find 18 options. I start by finding the average turnover rate: 76.87% and expense ratio 1.20% of funds in this category. Then I look at the Funds sorted by best 5 year annual performance and look for funds with $3000 or lower initial purchase minimum and $100 subsequent investment minimum and turnover and expenses equal to or lower than the minimum. I will also check whether they are consistently investing in mid cap companies. All these details are as of 11/12/06.

The first funds listed have done well but I rule them out for these reasons:

UMPIX ProFunds: UltraMid Cap/Inv has a really high 402.00% portfolio turnover, and a $15,000 initial minimum purchase as well as a 1.49% expense ratio.

ASMCX Accessor Funds: Small to Mid Cap/Adv has a $1,000 minimum for subsequent investment. Also this fund splits between mid and small cap companies and following this plan, we will select a separate fund covering small cap companies.

RIMSX Rainier Investment: Sm/Md Cap Eqty Port has a $25,000 initial min, $1,000 Subsequent min. In addition, it has a significant portion of its holdings in small cap companies.

ACSIX Accessor Funds: Small to Mid Cap/Inv has a $5,000 initial min. which is a little higher than I want but $1,000 Subsequent min. is much too high. The 1.64% expense ration is also above average and again, some of the recent out-performance is due to investing in small cap companies which have done well recently.

The next three funds listed:

CHTTX ABN AMRO Mid Cap Fund/N has very low portfolio turnover 27.42%, average expense ratio of 1.23%, and $2,500 and $50 initial and subsequent minimums. This is a definite candidate.

PESPX Dreyfus Index Fds: Midcap Index Fund has $2,500 and $100 initial and subsequent minimums, a 0.50% Expense Ratio and a low 19.54% turnover rate. Another candidate.

NTIAX Columbia Mid Cap Index Fund/A has $1,000 and $100 initial and subsequent minimums, a 0.39 Expense Ratio and a low 24.00% turnover rate. A third candidate.

In looking at CHTTX, I immediatley notice that it is investing a great deal in stocks of companies other than mid cap domestic companies. As you can see by this graphic:

Basically there are no managed funds that meet the criteria for my portfolio in the Mid Cap Blend style, but there are 2 index funds that do. Either PESPX or NTIAX would be a good option- both have low turnover rates and low expenses, as you would expect with index funds. There is one big difference PESPX has 2,269.3 million under management compared to 37.7 million for NTIAX. This could explain why the expenses on NTIAX are a little bit lower. NTIAX has slightly lower expenses and has ever so slightly out-performed PESPX over the 3 year and one year periods, so I will go with NTIAX.

When looking at funds available through Etrade, a fund available for a transaction fee (meaning it would not be a candidate for investing additional $100 contributions over time) VIMSX Vanguard Mid Cap Index/Inv has an even lower 0.22% expense ratio, and a low 18.00% portfolio turnover. There are a few other funds that have performed a bit better than this index fund, but they have 1% or more higher annual expense ratios and are investing in many sectors other than domestic mid cap companies. In addition to being cheaper, VIMSX has outperformed NTIAX, so it is too bad that it is not available for no fee.

11.10.2006

Etrade: Fees

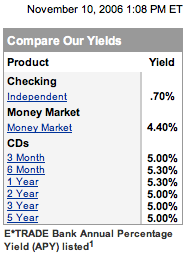

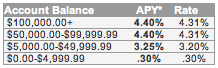

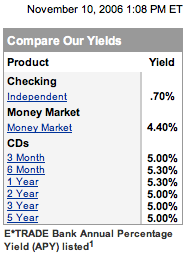

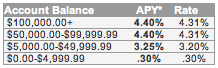

The info on this post is from 11/10/06 and will change so do your own research if you are interested in finding out more, whenever you are ready. Also, these are the fees that will or could impact a plan like the one I am proposing, not a complete list of fees.

Minimum Balance Fee:

$40 quarterly Low Balance Fee -if the balance in your E*TRADE Securities account is over $10,000 or the total combined balance in your linked E*TRADE Securities and E*TRADE Bank accounts is over $20,000 you do not have to pay this. Also, these fees are not charged for accounts in the first year (this is a nasty policy) .

You should not set up a non-retirement brokerage account with Etrade unless you have more than $10,000 that will remain there until the account is closed as paying $160 annually in maintenance fees is ridiculous and you can easily find a different brokerage that does not charge this. Also, I do not recommend opening an Etrade bank account. All their adds suggest a savings rate of 4.4% which is not great but not bad especially compared to what many local branches offer.

When you dig around, however, you will find that if your balance is under $5000, the current rate is .30%.

You can find an online bank account with better rates without balance restrictions. Bank Deals is an excellent site for tracking down online banks.

Minimum Balance Fee:

$40 quarterly Low Balance Fee -if the balance in your E*TRADE Securities account is over $10,000 or the total combined balance in your linked E*TRADE Securities and E*TRADE Bank accounts is over $20,000 you do not have to pay this. Also, these fees are not charged for accounts in the first year (this is a nasty policy) .

You should not set up a non-retirement brokerage account with Etrade unless you have more than $10,000 that will remain there until the account is closed as paying $160 annually in maintenance fees is ridiculous and you can easily find a different brokerage that does not charge this. Also, I do not recommend opening an Etrade bank account. All their adds suggest a savings rate of 4.4% which is not great but not bad especially compared to what many local branches offer.

When you dig around, however, you will find that if your balance is under $5000, the current rate is .30%.

You can find an online bank account with better rates without balance restrictions. Bank Deals is an excellent site for tracking down online banks.

11.08.2006

Brokerage Accounts: Thoughts about Etrade

I have an Etrade account and will limit my choices to funds available through Etrade, as long as I continue to use Etrade. Let me start by saying that I did not choose Etrade, but I am satisfied with it. I opened a Discover brokerage account which became a Morgan Stanley account which became a HarrisDirect account which then became an Etrade account. The things I keep an eye on are Fees, Mutual Fund offerings, Services and Tools, and Yields on cash held in the account. This can be a bit tedious since brokerages merge, get bought, and change fees and services constantly (see above), but unlike what the market does, you can control what fees you pay and what services you use by keeping abreast of what the competition is offering and change your brokerage if necessary. If you think about brokerages in this light, one of the most important things to identify before setting up an account is the “Account closing fee.”

Another point- The internet is overflowing with Etrade customer service complaints. I too have had difficult and tedious customer service experiences with Etrade, though like many- I was persistent and ultimately reached someone who helped me more than I thought they would. That said- I would be interested in hearing if other full service brokerages offer a broad range of no-load no-fee mutual funds and if other brokerages have better customer service. Such funds are also referred to as NTF (No Transaction Fee) Funds.

Before I start picking funds, I will look at Fees, Mutual Fund offerings, Services and Tools, and Yields on cash held in the account.

Another point- The internet is overflowing with Etrade customer service complaints. I too have had difficult and tedious customer service experiences with Etrade, though like many- I was persistent and ultimately reached someone who helped me more than I thought they would. That said- I would be interested in hearing if other full service brokerages offer a broad range of no-load no-fee mutual funds and if other brokerages have better customer service. Such funds are also referred to as NTF (No Transaction Fee) Funds.

Before I start picking funds, I will look at Fees, Mutual Fund offerings, Services and Tools, and Yields on cash held in the account.

11.07.2006

The Approach: Non-Retirement Portfolio

Let me start by indicating that this blend of stocks and (very few) bonds would be deemed “Extremely Aggressive” by most standards. While I think investing in a mix as diverse as this is actually less risky than investing in what many would consider a far less aggressive portfolio, I think it best to indicate that this is by no means meant to be strategy that does not run the risk of losing value. And continuing to add to a portfolio that is losing value month after month, as should happen at some point, will be trying, but should also garner better returns when the market trends upwards, as it should.

First I will identify market sectors I want to invest in. Large and Small companies, Growth and Value oriented businesses, International companies, Bonds, Real Estate Investment Trusts, etc. Then I will come up with an order in which I should add additional sectors to my portfolio to quickly diversify and then remain balanced as I increase the breadth of sectors I am invested in. I broke down portfolios based on the ability to invest monthly one of the following amounts: $300, $500, $1000, $1500, $2000, and $2500. I could certainly invest anywhere between $100 to $2500 but the placement of each sector at each point from 1 to 25 was intended to set up portfolios of 3, 5, 10, 15, 20, or 25 funds keeping each group loosely balanced.

For each sector I am going to research what no-load, no-fee funds are available to new investors in Etrade and which ones have $100 or less minimum for additional investments.. I am going to identify the top performing funds with a decent track record and then pick the fund with the lowest expenses and the lowest portfolio turnover. Turnover is critical because higher turnover can translate into higher annual tax bills, regardless of whether the performance is better or not. Since this is a non-retirement account, that can make a significant difference over the long term. I will also look at management tenure, average P/E ratios of stocks held within the fund, the initial amount required to purchase, etc.

I want to stress that I am not going to compare these factors in an extremely precise way. If the numbers of two funds are close, I am not going to follow a system and pick the one with a fraction of a percent lowers on one number or the other. I may choose a fund with higher expenses if the potential for performance seems greater (but it would have to be a lot greater to compensate for higher expenses over time) or if the turnover is lower, hoping the tax savings offset the expense difference. I will try and indicate the things I find in my research and the reasons I choose the funds I do.

First I will identify market sectors I want to invest in. Large and Small companies, Growth and Value oriented businesses, International companies, Bonds, Real Estate Investment Trusts, etc. Then I will come up with an order in which I should add additional sectors to my portfolio to quickly diversify and then remain balanced as I increase the breadth of sectors I am invested in. I broke down portfolios based on the ability to invest monthly one of the following amounts: $300, $500, $1000, $1500, $2000, and $2500. I could certainly invest anywhere between $100 to $2500 but the placement of each sector at each point from 1 to 25 was intended to set up portfolios of 3, 5, 10, 15, 20, or 25 funds keeping each group loosely balanced.

For each sector I am going to research what no-load, no-fee funds are available to new investors in Etrade and which ones have $100 or less minimum for additional investments.. I am going to identify the top performing funds with a decent track record and then pick the fund with the lowest expenses and the lowest portfolio turnover. Turnover is critical because higher turnover can translate into higher annual tax bills, regardless of whether the performance is better or not. Since this is a non-retirement account, that can make a significant difference over the long term. I will also look at management tenure, average P/E ratios of stocks held within the fund, the initial amount required to purchase, etc.

I want to stress that I am not going to compare these factors in an extremely precise way. If the numbers of two funds are close, I am not going to follow a system and pick the one with a fraction of a percent lowers on one number or the other. I may choose a fund with higher expenses if the potential for performance seems greater (but it would have to be a lot greater to compensate for higher expenses over time) or if the turnover is lower, hoping the tax savings offset the expense difference. I will try and indicate the things I find in my research and the reasons I choose the funds I do.

11.06.2006

The Plan: Non-Retirement Portfolio

What I am proposing is a plan for building a broadly diversified collection of mutual funds with automatic monthly investments in a non-retirement account. It is my hope that this is a good plan for me as someone with little to no credit card debt, reasonably stable income and living comfortably below my means. I also do not want to spend a great deal of time researching and staying on top of individual stocks and bonds. This is a plan for growing wealth, not generating additional income. It is a plan for long-term investing.

If I did not have the income to invest at least $300 per month- this would not be a good approach. I will be choosing funds that charge no fee to purchase. There are funds in every sector I will pick that would be better options if I had a fixed amount of money I wanted to invest in a specific fund all at once. I am limiting my choices to funds that will allow automatic investing because I believe that the discipline of contributing consistently will mean I invest more and the benefit of investing over time through market peaks and valleys will help reduce the negative impact of buying during a market peak.

Each mutual fund will have a minimum investment amount to initially purchase the fund and each fund I choose will have $100 or less additional investment minimum. This plan should work for me as long as I can add between $300 and $2500 per month (That is a big range, but I am serious about building wealth. It should work for me if my financial situation improves meaning if I can invest $300 per month now and can bump that up to $500 later, it should work well. It should be scalable. It should allow me to add additional funds slowly as I save the additional money needed to add each new fund.

If I could invest more than $2500 per month, but still do not want to get more active than this in managing my own investments, I would probably research and hire a good financial planner or advisor. Some will argue that I should do this anyway and some will argue that if I have over $500 I should do this. I am not recommending that you do anything. I hope to build a plan that will build a diversified portfolio of funds that should be a relatively low maintenance way to invest over the long term without stressing about timing the market.

If I did not have the income to invest at least $300 per month- this would not be a good approach. I will be choosing funds that charge no fee to purchase. There are funds in every sector I will pick that would be better options if I had a fixed amount of money I wanted to invest in a specific fund all at once. I am limiting my choices to funds that will allow automatic investing because I believe that the discipline of contributing consistently will mean I invest more and the benefit of investing over time through market peaks and valleys will help reduce the negative impact of buying during a market peak.

Each mutual fund will have a minimum investment amount to initially purchase the fund and each fund I choose will have $100 or less additional investment minimum. This plan should work for me as long as I can add between $300 and $2500 per month (That is a big range, but I am serious about building wealth. It should work for me if my financial situation improves meaning if I can invest $300 per month now and can bump that up to $500 later, it should work well. It should be scalable. It should allow me to add additional funds slowly as I save the additional money needed to add each new fund.

If I could invest more than $2500 per month, but still do not want to get more active than this in managing my own investments, I would probably research and hire a good financial planner or advisor. Some will argue that I should do this anyway and some will argue that if I have over $500 I should do this. I am not recommending that you do anything. I hope to build a plan that will build a diversified portfolio of funds that should be a relatively low maintenance way to invest over the long term without stressing about timing the market.

Subscribe to:

Comments (Atom)