Well, the portfolios took the worst one week swan dive, since I started my little experiment. The markets may stink, but I'm getting used to the smell.

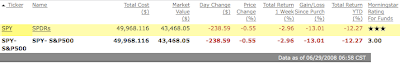

I'm pleased at how well the diverse portfolios have held up, compared to just diving into the S&P 500. Down about 5% is better than down 13%.

Despite all the terrible economic news, don't lose perspective. Had you invested $50k on May 1st of 2007 in the WylieMoney 20 Mostly managed portfolio, you would be down only 2.5%. Sure you can point out that even dismal money market accounts have done better than that.

Hindsight is great.

Money Market funds will never grow as much as investments in equity markets might. Stash your money in a Money Market fund if you want to be safe- but for those of us with better things to do than survive, equities are the way to go.

Apologies to Ani (pronounced ah-nee) for terrible misappropriation of a great song.